- Home

- Administration

- Aeronautics

- Business with WYDOT

- Construction Projects

- Driver License and Records

- Economic Stimulus Projects (ARRA - TIGER)

- Engineering and Technical Programs

- Fuel Tax

- Highway Safety

- Human Resources

- Manuals and Publications

- News and Information

- Permits

- Planning/Projects/Research

- Titles, Plates and Registration

- Travel

- Trucking / Commercial Vehicles

- Vehicle Business Regulation

- Wyoming Highway Patrol

- Search

- Sitemap

19 projects planned for additional fuel tax revenue in FY 2014

September 3, 2013

WYDOT plans to work on 19 additional highway projects during fiscal year 2014 with the projected increase in fuel tax revenues it expects to receive during the year.

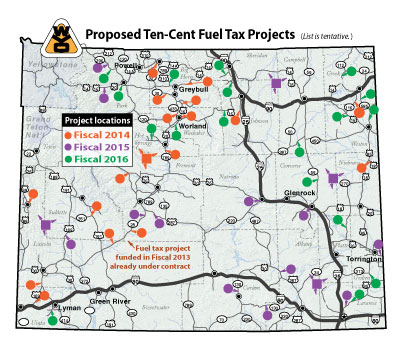

Those projects are among 52 the department proposes to begin over the next three fiscal years using the estimated $47.5 million a year in additional fuel tax revenue. A map and descriptions of the proposed projects are available for viewing.

Preliminary work has already begun on the first project to be paid for with the added fuel tax revenue. McGarvin-Moberly Construction has begun crushing rock for new pavement on a 10-mile section of Wyoming Highway 28 south of Lander, but due to seasonal considerations, paving won’t begin until spring. The Wyoming Transportation Commission awarded the $3.8 million contract to the Worland company on July 18, and the contract completion date is July 31, 2014.

The proposed 2014 projects include bridge rehabilitation work at various locations in the northwest portion of the state, pavement rehabilitation on 16 highway sections totaling more than 100 miles, and a two-mile section of US 26-287 will be reconstructed due to its poor condition.

“The legislative goal of the 10-cent fuel tax projects is to maintain the highway system in the condition that it currently exists today,” WYDOT Assistant Chief Engineer Gregg Fredrick said. “We’re focusing it on those roads that connect Wyoming’s communities that aren’t on the interstate system.”

The additional projects being moved into the State Transportation Improvement Program (STIP) for fiscal 2014 are not new.

“There was an identified need for this work, but the projects had been delayed in the STIP because of funding constraints,” Fredrick said. “We had already done some preliminary engineering, but now we’re accelerating the design to bring those projects into fiscal years 2014, 2015 and 2016.”

The STIP is a six-year plan for highway projects, so, as the additional tax revenue allows WYDOT to move some projects ahead in the schedule, it also will enable additional projects to enter the plan for future years.

The tentative plan for using the additional fuel tax money the department will receive includes another 16 projects in fiscal 2015, and 18 projects in fiscal 2016.

“It’s pavement and bridge rehabilitation and we’re using our asset management system to help us identify and prioritize the needs throughout the state,” Fredrick said.

The asset management system is made up of pavement, bridge and safety management components. It identifies and prioritizes necessary work, and, if recommended rehabilitation can be completed in time, the need for reconstruction work that costs four to eight times more can be delayed.

“Timely rehabilitation is important and it’s cost effective to ensure the long-term serviceability of the roadway,” Fredrick said. “This additional funding is really going to help maintain the state’s roadways.”

The expected increase of $47.5 million a year in funding from the fuel tax represents about a 15 percent increase in WYDOT’s construction budget for fiscal 2014.

“We’re happy to have this long-term funding source that we can count on and plan around and use to benefit the highway system,” WYDOT Director John Cox said. “The approach specified by the Legislature will help with improvements in highway conditions around the state.”